1.1.1. American Clark was the pioneer of forklifts, and Japanese forklifts came later

The emergence of the forklift is one of the events that had a major impact on the world's industrial development in the twentieth century. In 1916-1917, the machines used by Clark Company for transporting sand and raw meal became the pioneer of industrial forklifts, and the Duat forklift produced in 1926 is considered to be the originator of counterbalanced forklifts. In the mid-1960s, Japanese forklifts penetrated the European and American markets with low prices and the introduction of new models. Facing market competition and U.S. sanctions, Japanese forklifts deployed in advance, set up factories in Europe and the United States, and continued to expand export sales. In recent years, Japanese forklifts have become one of the most popular material handling tools in the world, and Toyota has grown into a global leader in forklift manufacturing.

1.1.3. Forklifts are widely used downstream, and different categories correspond to different needs

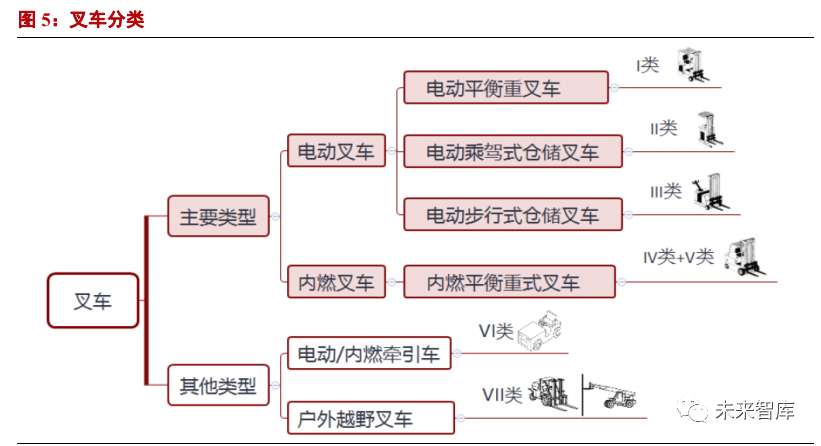

There are four main types of forklifts, and different categories correspond to different needs. The main types of forklifts include: internal combustion counterbalanced forklifts, electric counterbalanced forklifts, electric ride-on storage forklifts, and electric walking storage forklifts, which correspond to the forklifts of Class IV/V, I, II, and III of the European and American classification standards, respectively. Electric forklifts run smoothly, have low noise, and have no polluting exhaust gas, but their traction force and endurance are poorer than those of internal combustion forklifts. They are mainly used in indoor environments with short handling distances, low weight, and high operating environment requirements. For environmental protection and energy saving considerations, electric counterbalanced forklifts are mainly used as an alternative to outdoor internal combustion counterbalanced forklifts.

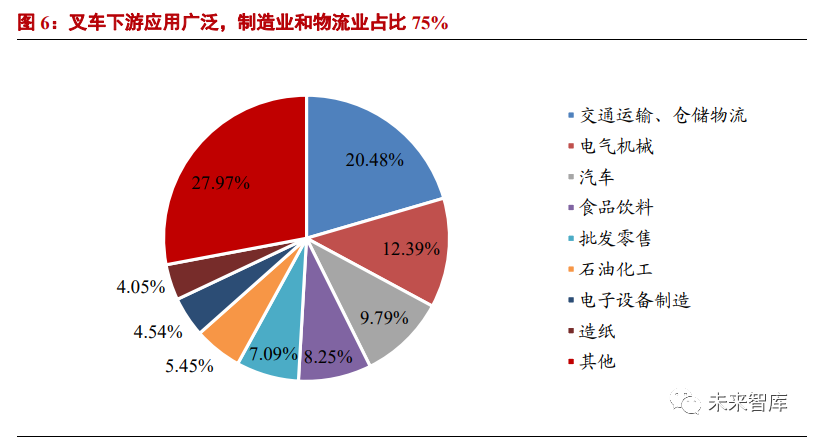

Forklifts are widely used downstream, with stable demand, and the manufacturing and logistics industries account for a large proportion. Forklifts are widely used in ports, stations, airports, freight yards, factory workshops, warehouses, circulation centers and distribution centers, etc. Among them, the manufacturing and logistics industries have the largest demand for forklifts, and the total demand accounts for about 75% of the downstream industry demand for forklifts, while sales to manufacturing The ratio of industry and logistics is about 2:1. In general, forklifts have a wide coverage, and downstream applications are "not bright in the east and bright in the west", and the

demand is relatively stable.

Benefiting from the high prosperity of the manufacturing and logistics industries, the industry demand is very strong. Forklift sales are mainly affected by the macro economy, and its growth rate is highly correlated with the growth rate of the "barometer" manufacturing PMI index; among which the sales growth rate of storage forklifts (Class II and III vehicles) is related to the growth rate of express delivery business. After the explosive growth in 2016, the growth rate of business volume has remained above 24% in the past three years. After the epidemic was brought under control in 2020, the manufacturing PMI index from March to September stood on the line of prosperity and decline for seven consecutive months, and business confidence continued to increase. Benefiting from the recovery of the manufacturing industry and the sustained high growth of the logistics industry, the sales volume of forklifts in the first three quarters of 2020 increased by 24.1% year-on-year, and the demand was very strong.

1.2. The international brand structure is stable, the domestic enterprises have huge room for growth, and the industry concentration is continuously improved

1.2.1. The global forklift industry is highly concentrated, and domestic companies are more likely to grow

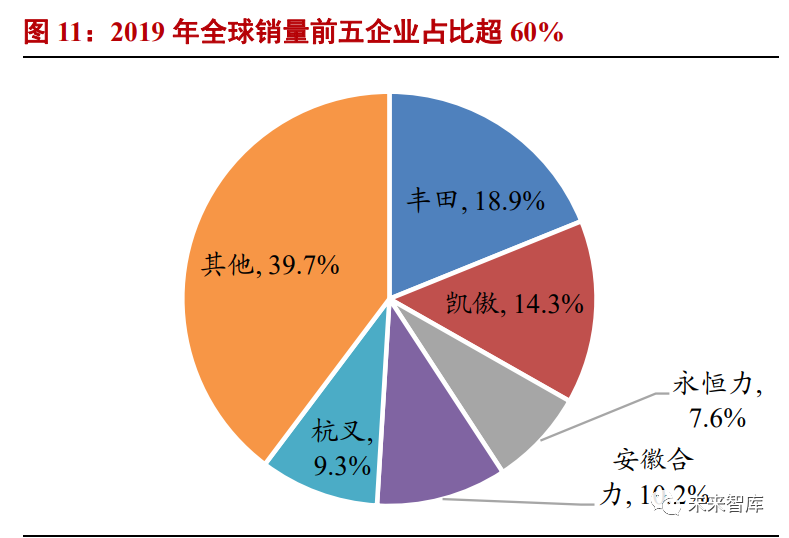

The scale of the domestic forklift leader is only about 10% of that of the international leader, and there is huge room for improvement. According to the data released by the American magazine "Hyundai Material Handling" in 2020, Japan's Toyota forklifts sold a total of 282,000 forklifts in 2019, accounting for 18.9% of global sales, and achieved revenue of US$13.36 billion, ranking first in the world.

Domestic forklift companies Anhui Heli and Hangcha Group ranked 7th and 8th in terms of revenue, only about 10% of Toyota. In terms of sales volume, the top five companies in global sales in 2019 accounted for more than 60%, indicating a high degree of industry concentration. Heli and Hangcha sold 152,000 and 139,000 forklifts respectively in 2019, ranking third and fourth in the world. The unit price of forklifts in China is relatively low, and the aftermarket has not been fully developed. In addition, the domestic forklift market demand continues to be strong, and the scale of domestic forklift companies has huge room for improvement.

In some areas, the competition of multiple companies has evolved into an oligarchic structure. Currently, Japan, Germany, the United States, China and South Korea each occupy two of the top ten forklift trucks in the world. The development of forklifts has a history of 100 years. In the early stage of the industry, vehicle and machinery equipment manufacturers from all over the world have entered the industry to explore. As the industry continues to mature, leading companies actively acquire and expand by virtue of their resource advantages, gradually widening the gap, and the forklift industry in some countries has evolved from the competition of multiple companies to an oligarchic pattern.

At present, the world's top ten forklift companies are composed of two companies from five countries: Japan, Germany, the United States, China and South Korea. Among them, the US, China, and South Korea forklift industry have a double-leading pattern. The top two companies are ranked adjacent to each other and have similar scales; Japan's Toyota and Mitsubishi Lizhiyou are ranked first and fourth in the world, with a difference of 2-3 times in scale; The gap between KION and Jungheinrich in Germany is obvious.

The global strategic layout has established the leading advantages of Toyota and KION, and the growth path of international brands is worthy of our reference. Looking at the growth and development history of the top ten forklift companies, long history and active mergers and acquisitions are common characteristics, and the absolute leading edge of Toyota and KION is determined by their global strategic layout. In the early years, Toyota penetrated the European and American markets by virtue of its low prices and the introduction of new models, and had its own factories in Japan, the United States, France, China and Sweden. On the one hand, KION consolidates and expands the European market, and on the other hand, it rapidly expands to Southeast Asia, South Asia, South America, China and other regions: the establishment of South Asia KION, the cooperation with India Portas Material Handling Co., Ltd., the establishment of a factory in Sao Paulo, South America, the development of Become my country's largest foreign-owned forklift manufacturer. It can be seen that in addition to the strong domestic market demand, the overseas market that needs to be further expanded also constitutes a potential growth space for China's leading forklift companies.

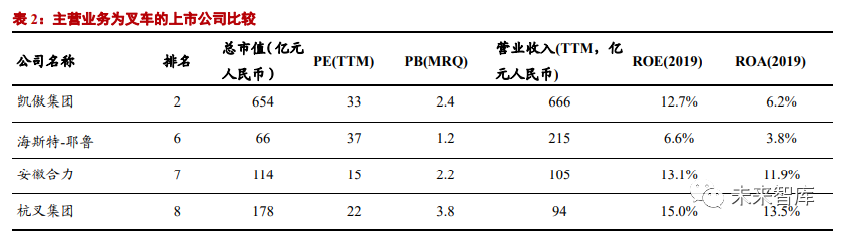

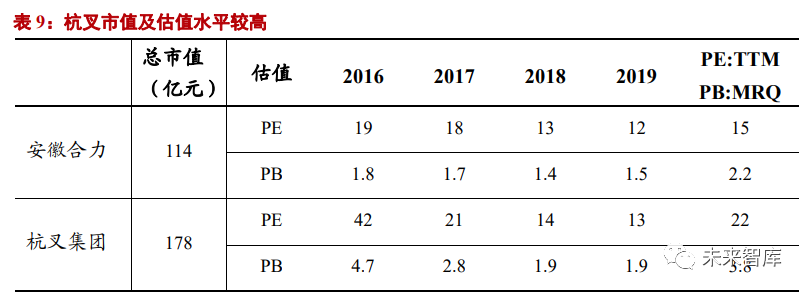

Compared with overseas listed companies whose main business is forklifts, domestic forklift leaders have lower valuations and better profitability. In 2019, the ROE of Heli and Hangcha were 13.1% and 15.0%, respectively, higher than 12.7% and 6.6% of KION and Hyster-Yale, and their profitability was better than that of leading overseas forklift companies. As of November 25, 2020, the valuation levels of Heli and Hangcha were 15 times and 22 times, respectively, while that of KION and Hyster-Yale were 33 times and 37 times, respectively. The domestic forklift leader has a low valuation level, good profitability, and a large room for scale improvement. Compared with international companies, it has more growth potential.

1.2.2. The domestic market share of overseas brands has a significant downward trend

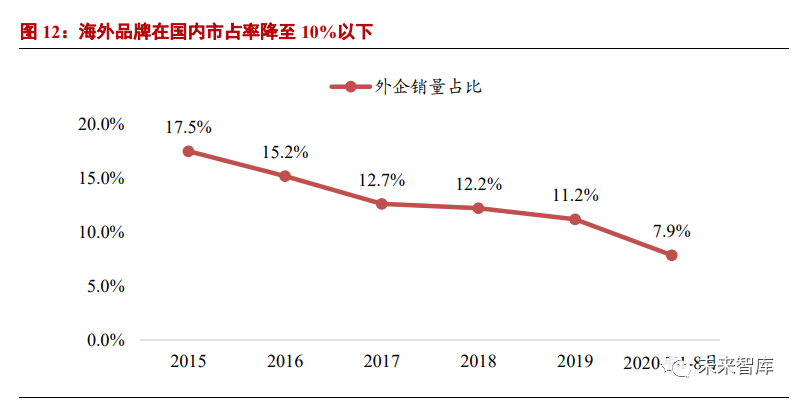

After years of technology accumulation and continuous R&D investment, domestic brand product series integrity, core technology control capabilities, testing and testing levels, design and R&D processes and other technical quality management have surpassed the international industry level. In terms of electric and intelligent, the domestic leader The company is an international leader. Domestic forklifts are cheap and cost-effective. When the epidemic broke out in 2020, domestic forklift leaders actively resumed work and production, reduced prices and promoted sales, and seized the share of foreign companies. From January to August, the share of overseas brands in domestic sales fell to 7.9%.

1.2.3. The competition in the domestic forklift industry is fierce, and the industry concentration will increase significantly in 2019-2020

Compared with other construction machinery, the forklift industry has lower barriers and competition tends to be fierce. According to the data of China Fork Network, in 2019, there were 15 industrial vehicle manufacturers with annual sales of more than 10,000 vehicles, 21 with more than 5,000 vehicles, 29 with more than 3,000 vehicles, and 33 with more than 2,000 vehicles. Up to now, there are still about 130 vehicles in the industry. enterprise. However, the survival ability of large forklift companies is stronger than that of small and medium-sized enterprises. With competition, the industry structure will continue to be optimized.

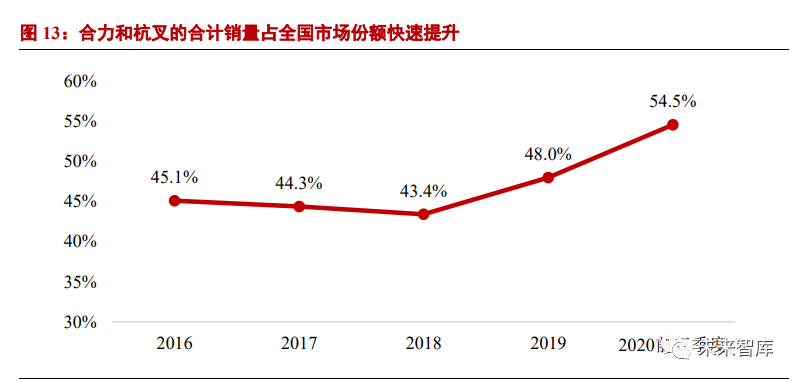

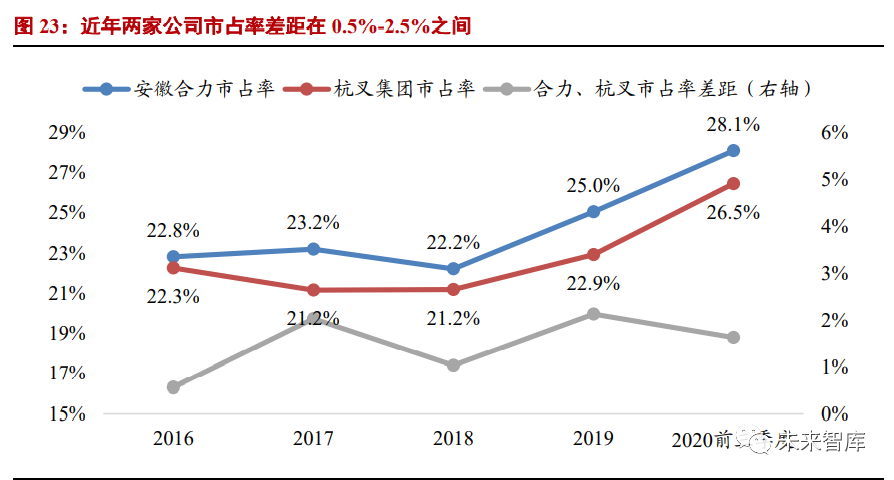

In terms of sales volume, domestic leading enterprises Anhui Heli and Hangcha Group accounted for 48% of the national forklift market share in 2019, and the top 10 sales companies accounted for more than 76% of the country's total sales. In the first three quarters of 2020, the competition among leading companies has intensified, and prices have been greatly reduced, squeezing the living space of small and medium-sized enterprises, and the industry concentration has further increased. The market share of Heli Hangcha exceeds 54%. Among them, the two companies of category IV/V accounted for 68%; the total proportion of category I vehicles was 44%; the proportion of category III vehicles was slightly lower, less than 20%. It is expected that in the next two years, the combined sales volume of the two companies is expected to exceed 60% of the national market share.

1.2.4. The cost-effective advantage of domestic brands has brought about an increase in global market share, and there is huge room for overseas market expansion

Domestic forklifts in overseas markets are cost-effective. The export of domestic forklifts in my country is basically high-end products, and the quality is almost the same as that of well-known international brands. The price of exporting to the United States and Europe is usually 20-50% higher than the domestic price, but the price is still lower than that of international leading brands. The export price of a commonly used domestic combustion forklift is about 10,000 to 15,000 US dollars, while the price of a Toyota diesel forklift is 16,000 to 30,000 US dollars. 50%-100%.

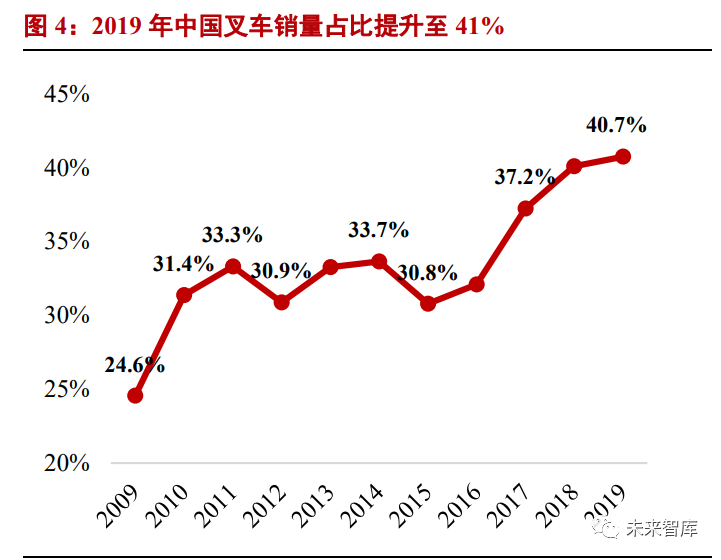

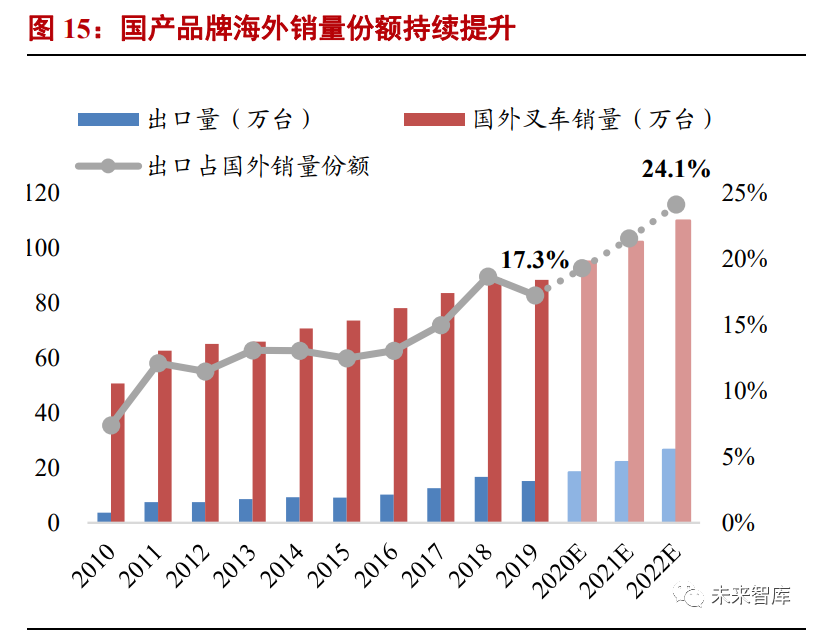

The global market share of domestic forklifts has gradually increased, and there is huge room for overseas market expansion. With the continuous improvement of the international recognition of domestic forklifts, the global market share of domestic brands has gradually increased by virtue of their cost-effective advantages, increasing by 15 percentage points to 36.2% in 2009-2019. According to the data of the Construction Machinery Industry Association, the number of forklifts exported from my country increased from 24,122 to 152,825 from 2010 to 2019, with an average annual compound growth rate of 20.3%, and its share of overseas sales increased from 7.4% to 17.3%.

Among them, the proportion of domestic brands in developed countries is slightly lower, about 5-10%; in developing countries, it is higher, about 20%-50%, mainly due to different product positioning and customer needs. For domestic forklift brands, there is huge room for expansion in overseas markets in the future. We expect that the scale of the overseas market will maintain an average annual growth rate of 6-8%, and the total overseas sales will increase to 1.1 million units by 2022; it is expected that the penetration of domestic forklifts will accelerate, and the average annual growth of export units will be 20% in the next three years. In 2022, the export volume is expected to exceed 250,000 units, accounting for more than 24% of overseas sales.

1.3. The industry boom is expected to continue, electric intelligence is the general trend, and the aftermarket business needs to rise

1.3.1. The up-cycle of the forklift industry’s prosperity can reach 2-3 years, and the industry’s prosperity is expected to continue in the next two years

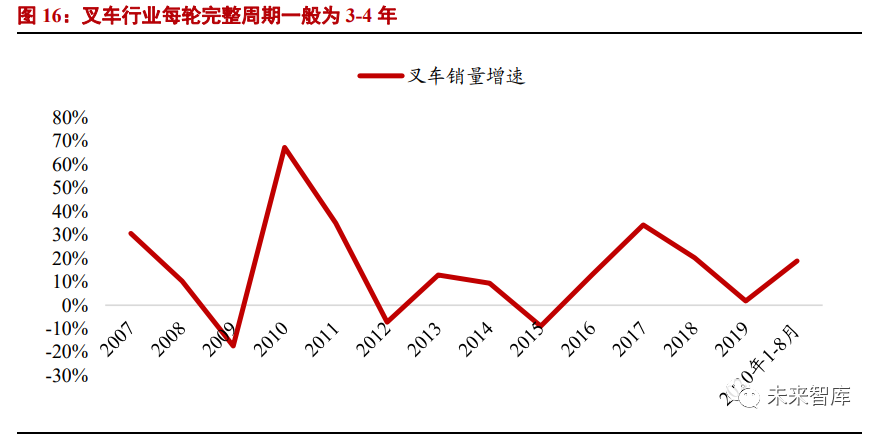

Affected by downstream manufacturing and macroeconomic fluctuations, the growth rate of forklift sales is obviously cyclical. The upward cycle of prosperity is about 2-3 years. This cycle reaches an inflection point in 2019, and the growth rate will pick up in 2020. At present, the prosperity of the downstream industry is still on the rise, and the prosperity of the forklift industry is expected to continue in the next two years.

1.3.2. The general trend of electrification and intelligence of forklifts, the gross profit margin of the industry is expected to increase

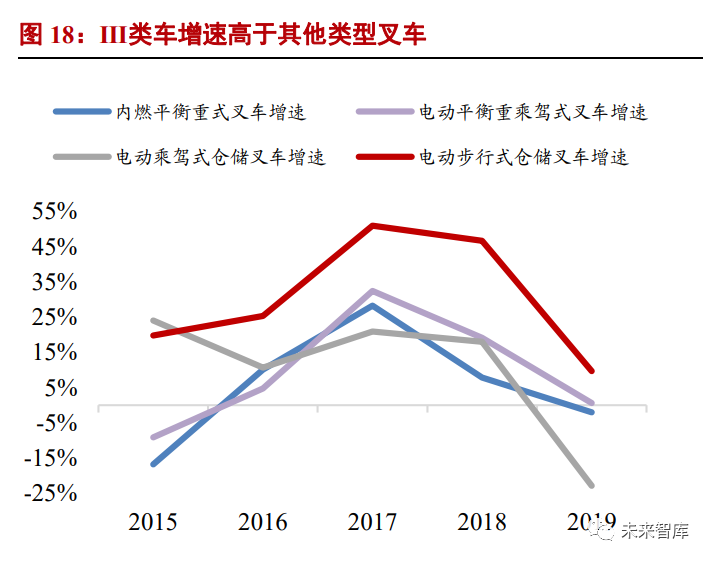

The proportion of electric forklifts is on the rise, and the growth rate of class III vehicles is the highest. Driven by environmental protection policies and indoor operating environment requirements, the demand for electric forklifts continued to grow, and the proportion of electric forklift sales in 2013-2019 increased year by year from 27.1% to 49.1%. In the sales structure of forklifts in developed countries, electric forklifts account for more than 60%, and the proportion of electric forklifts in my country will continue to increase in the future. Among the four types of forklifts, electric walking storage forklifts (Class III vehicles) have grown the fastest in the past five years. Class III vehicles mainly replace traditional manual scooters, with low technical barriers and can greatly reduce labor intensity. One Class III vehicle is equivalent to 10 manual scooters, but the price is only 4-5 times that of manual vehicles. At present, the global sales of manual scooters are about 3 million units, almost all of which are from China. In the future, Class III vehicles can replace at least 10% of them, which has good growth attributes.

The penetration rate of electric counterbalance forklifts is gradually increasing, and internal combustion forklifts will still occupy a place in the future. Internal combustion counterbalanced forklifts have the same usage scenarios as electric counterbalanced forklifts, each with their own advantages and disadvantages. The average price of internal combustion forklifts is around 55,000 to 60,000 yuan, which is relatively cheap and easy to purchase. Diesel engines are more reliable and powerful, but the cost of adding diesel fuel is high, and the emission of smoke and dust is likely to cause environmental pollution; the price of electric forklifts is about twice that of internal combustion forklifts , but its noise is small, it meets environmental protection requirements, and the use cost is only 1/3 of the internal combustion forklift. At present, the proportion of electric counterbalance forklifts is about 30%, and the proportion of internal combustion is about 70%. With the tightening of environmental protection policies and changes in user habits, the proportion of electric counterbalanced forklifts will further increase, but the more suitable internal combustion forklifts in certain scenarios will still have a place in the future.

The implementation of the National IV standard and the replacement of electric vehicles will bring about an increase in the gross profit margin of the industry. At present, the sales of internal combustion forklifts on the market are still mainly based on the National III emission standard of 3.5 tons. The average sales price of standard models is about 55,000 yuan, and the price of high-end vehicles can reach 65,000-70,000 yuan, but the proportion is relatively low. The National IV emission standard is expected to be implemented next year. By then, the average sales price of internal combustion standard forklifts is expected to increase by 10-15% to RMB 61,000-63,000, and the engine cost and gross profit margin will increase. In addition, the improvement of the emission standard of internal combustion vehicles will promote the replacement demand of electric vehicles, the gross profit margin of electric forklifts is higher, and the trend of electrification of forklifts will also promote the increase of the gross profit rate of the industry.

Intelligent unmanned forklifts have broad prospects. Compared with traditional forklifts, AGV forklifts do not require manual driving. In addition to charging, they can work 24 hours a day. They have basic features such as low cost, high efficiency, and flexible production, which can solve the problem that traditional forklifts are difficult to operate in harsh weather and dangerous environments. , which can reduce exhaust gas and noise, and can also be customized to meet the individual needs of enterprises, and has a very broad market prospect.

1.3.3. Aftermarket business to be developed: maintenance and spare parts replacement, forklift rental

The market for repairs and replacement parts kits will usher in a boom. Domestic consumers and Western consumers have different consumption habits. Western consumers are accustomed to using forklifts for a long time until they are scrapped; domestic consumers are accustomed to using cheap products and replacing forklifts with new ones when they have major failures. With the continuous iteration of domestic forklifts and the continuous improvement of the overall quality, the phenomenon of "repair by replacement" will gradually decrease, superimposed on the growth of the number of forklifts, the maintenance and replacement parts replacement market will usher in prosperity.

The domestic forklift leasing business accounts for a relatively small proportion. Toyota, the international forklift leader, only accounts for about 42% of its revenue, and the rest of its revenue comes from service business, with leasing services accounting for a larger proportion; while Chinese forklift companies’ service business revenue accounts for less than 10%, a small proportion, and a large proportion. Room for improvement.

The development of forklift leasing can be expected in the future. For leasing companies, the fixed cost of the forklift leasing business has a short payback period of only about 1 year, plus operating costs, it can be profitable in 2-2.5 years. For enterprises, forklift leasing can effectively avoid risks such as forklift replacement and maintenance information asymmetry, and has advantages in flexibility. As the number of forklift companies involved in the leasing business continues to increase, the leasing market continues to mature, and it continues to integrate with the second-hand forklift sales market. The future of forklift leasing is promising, and the forklift industry ecosystem will become healthier.

1.3.4. Domestic forklift sales are expected to exceed 1 million units in 2022

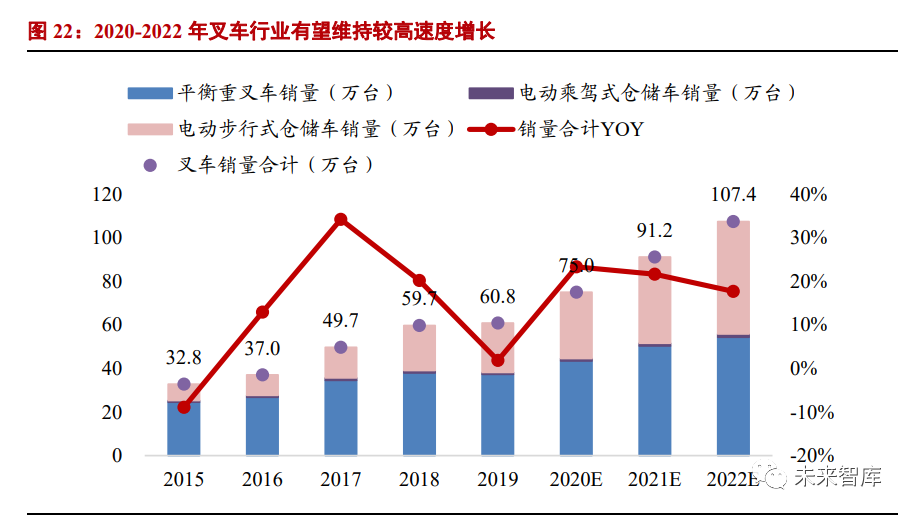

According to the forecast results, domestic forklift sales in 2020-2022 will be 750,000 units, 910,000 units, and 1.07 million units, respectively, with year-on-year growth rates of 23.3%, 21.6%, and 17.7%, respectively. Driven by factors such as low-price competition in the forklift market, electrification of counterbalanced forklifts, replacement of manual pallets, and the upward cycle of the macro economy, the forklift industry is expected to maintain a relatively high growth rate in the next year and the next year. billion.

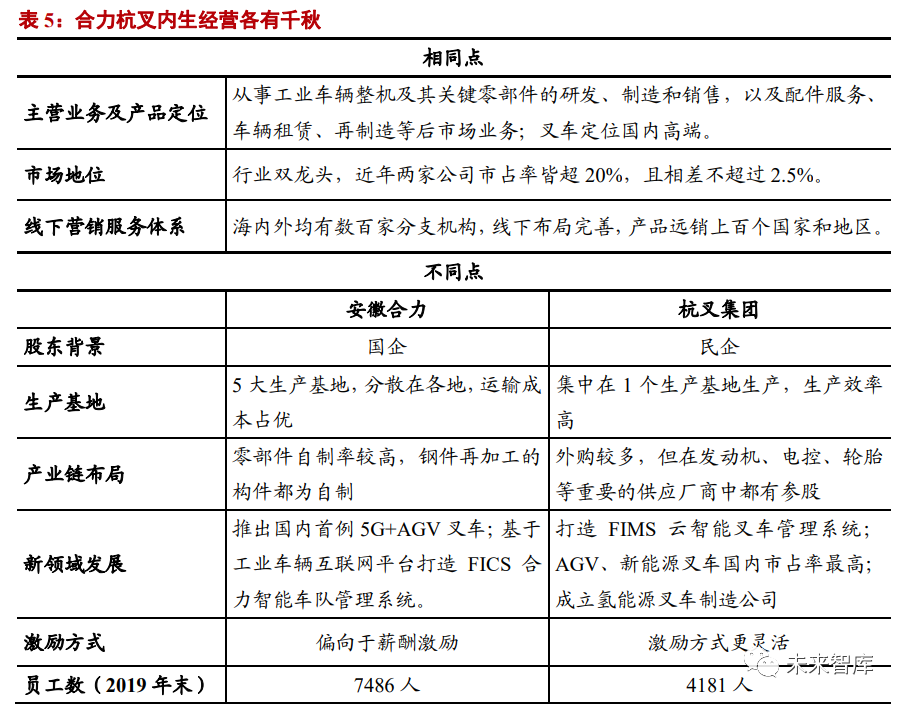

As the duopoly of the industry, Heli and Hangcha have different competitive advantages. In this part, we will analyze the two at the endogenous management level, and deeply analyze their comparative advantages. From a comprehensive perspective, the two leading companies have their own advantages in endogenous operations: Heli has superior transportation costs, while Hangcha has higher operational efficiency. Both companies are at the forefront of the industry in emerging fields and channel construction.

2.1. The business model and product positioning are almost the same, and the market share of Shuangliang is close to

The main businesses of Anhui Heli and Hangcha Group are the R&D, manufacturing and sales of complete industrial vehicles and their key components, as well as aftermarket services such as spare parts services, vehicle leasing, and remanufacturing; the main products include electric counterbalanced forklifts , warehouse-type forklifts, internal combustion counterbalanced forklifts, heavy loading vehicles, tractors, loaders, intelligent logistics (forklift-type AGV) systems and forklift-vehicle networking systems, etc., and are positioned as high-end domestically. Heli Hangcha is a double leader in the domestic forklift industry, with a similar market share. The gap in market share has remained within the range of 0.5%-2.5% in recent years. Heli has been No. 1 in China for 29 consecutive years, and the management attaches great importance to its industry status and market share. Based on this, we expect the market share of the two companies to maintain a gap of 1%-3% in the next three years.

2.2. Different shareholder backgrounds: Heli is a state-owned enterprise, Hangcha is a private enterprise

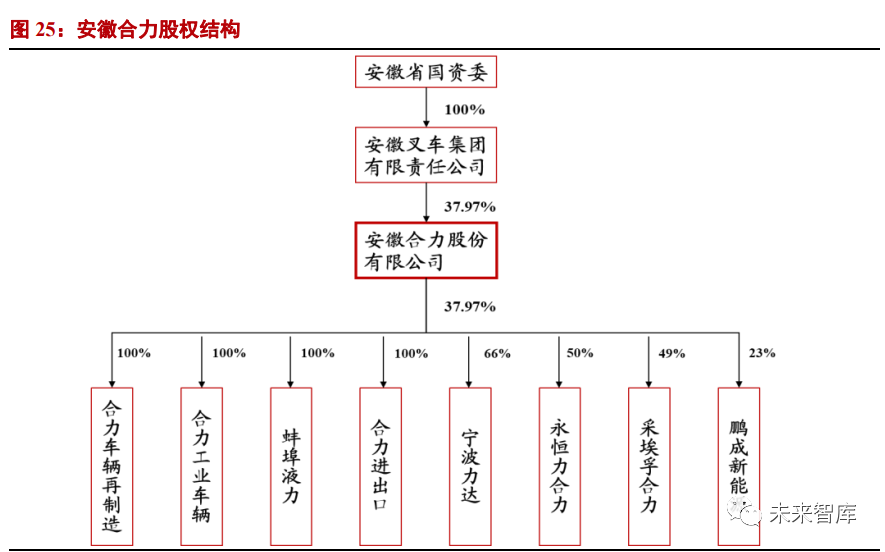

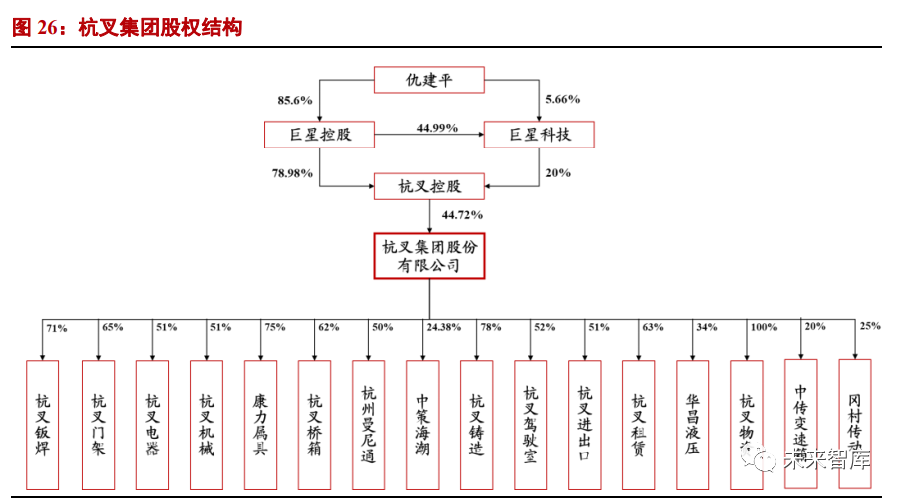

Heli Hangcha has a different development history. Heli was formerly known as the new Hefei Mining Machinery Factory established in 1958. In 1983, it changed its main business direction to forklifts. In 1991, it became a leading domestic forklift company and was listed on the Shanghai Stock Exchange in 1996. Hangcha was formerly known as the Hangzhou Machinery Repair Factory established in 1956. It was restructured in 2000 and listed on the Shanghai Stock Exchange in December 2016.

The shareholders of Heli Hangcha have different backgrounds. Anhui Heli is a state-owned enterprise. Its controlling shareholder, Anhui Forklift Co., Ltd., is 100% controlled by the State-owned Assets Supervision and Administration Commission of Anhui Province. It has 27 wholly-owned, controlled and joint-stock subsidiaries. Its actual controller is Mr. Qiu Jianping, and the second largest shareholder is Hangzhou Industrial Investment Group Co., Ltd., which is 100% controlled by Hangzhou State-owned Assets Supervision and Administration Commission.

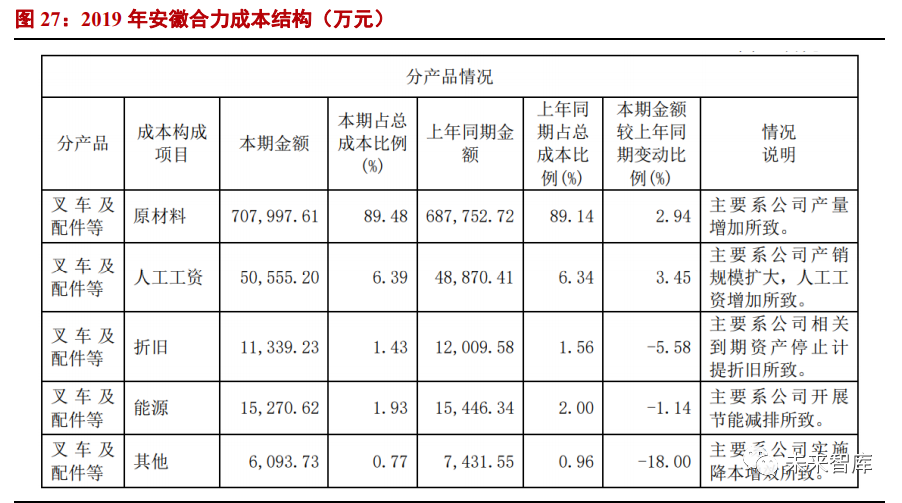

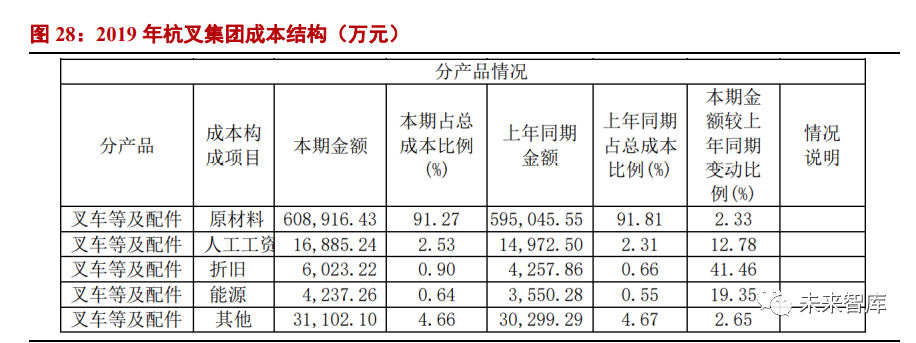

2.3. Heli transportation cost is dominant, Hangcha is more efficient in employing people

The upstream layout of Heli Hangcha's industrial chain is different, but the cost ratio of parts and components of the two companies is similar. Heli has core parts and components systems such as Hefei Casting and Forging Plant, Bengbu Hydraulic Company, Anqing Axle Plant, etc., and the parts are self-made. The processed components are all self-made, and there is still room for efficiency improvement; Hangcha has its parent company controlling Xinchai in terms of engines, cooperating with Jiachen in terms of electronic control, and participating in Zhongce Rubber in terms of tires. In 2019, the raw material costs of Heli and Hangcha were 7.08 billion yuan and 6.09 billion yuan respectively, accounting for 70% and 69% of sales revenue, which were similar.

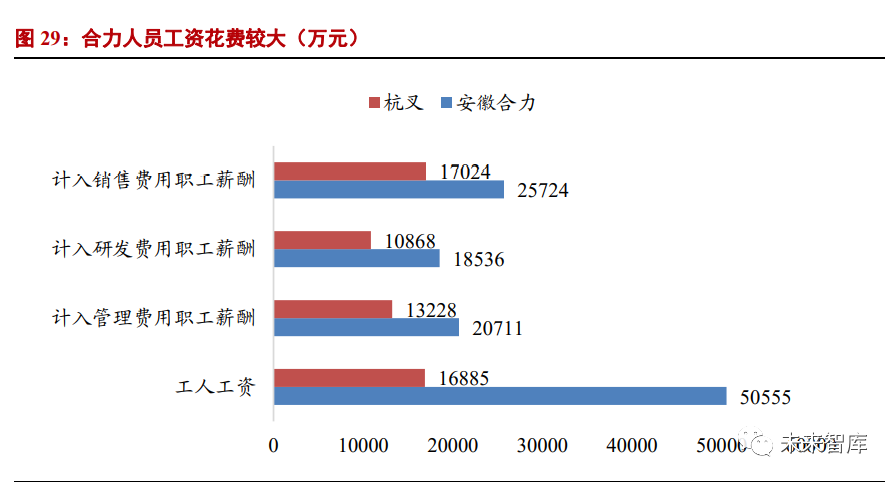

The number of Heli employees is nearly twice that of Hangcha, and personnel wages account for a larger proportion of revenue. As of the end of 2019, Anhui Heli and Hangcha Group had 7,486 and 4,181 employees respectively, with a total salary of 1.16 billion yuan and 580 million yuan, accounting for 11.4% and 6.6% of the company's revenue respectively. times, and the cost of personnel salaries is relatively large.

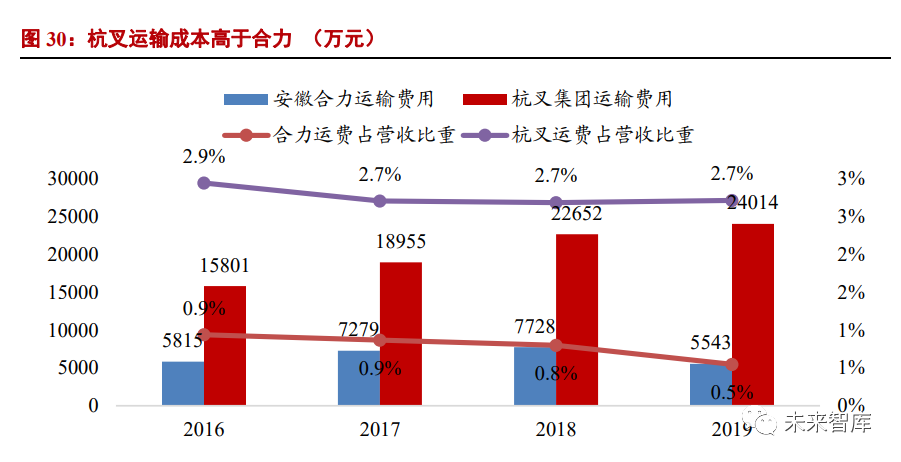

The transportation cost of Hangcha is higher than that of Heli, which affects the net profit margin by about two points. Hangcha has 1 production base, while Anhui Heli has 5 production bases, with Hefei headquarters as the center, a factory in Baoji in the west, Hengyang in the south, Panjin in the north, Ningbo in the east, and transportation costs. has a greater advantage. In the past four years, the transportation cost of Hangcha accounted for more than 2.7% of the revenue, while the combined force was only less than 1%, and it showed a downward trend year by year.

2.4. Heli Hangcha's marketing service system is perfect, and Hangcha's online layout is the highlight

Heli Hangcha has a complete marketing service system. Heli has a marketing network consisting of 24 provincial-level institutions and more than 400 branches in China. It has established sales agency relationships in more than 80 countries overseas, and its products are exported to more than 150 countries and regions; Hangcha has established 70 domestic and foreign markets. A number of direct sales branches, subsidiaries and more than 500 authorized dealers and franchise stores, serving customers in more than 180 countries and regions around the world.

Hangcha's online marketing empowers brand promotion. In recent years, Hangcha has made a lot of attempts in the integration of online and offline, including "online mall", "4S experiential physical store", "live broadcast forklift sales", "VR virtual exhibition hall" and so on. Hangcha has built its own F2C/F2B e-commerce platform, iMob Mall, and opened B2C Tmall flagship store and Jingdong flagship store to realize online sales of forklift trucks. It also has official homepages on Douyin, Facebook and other platforms to quickly improve online sales. Brand influence. During the "618" E-commerce Festival in 2020, Hangcha tried online live broadcast for the first time. The live broadcast was watched by more than 40,000 people, and nearly 100 crossovers were directly generated. The transaction amount was several million yuan, and the results were good.

2.5. Heli Hangcha is at the forefront of the industry in the field of new energy forklifts and intelligent forklifts

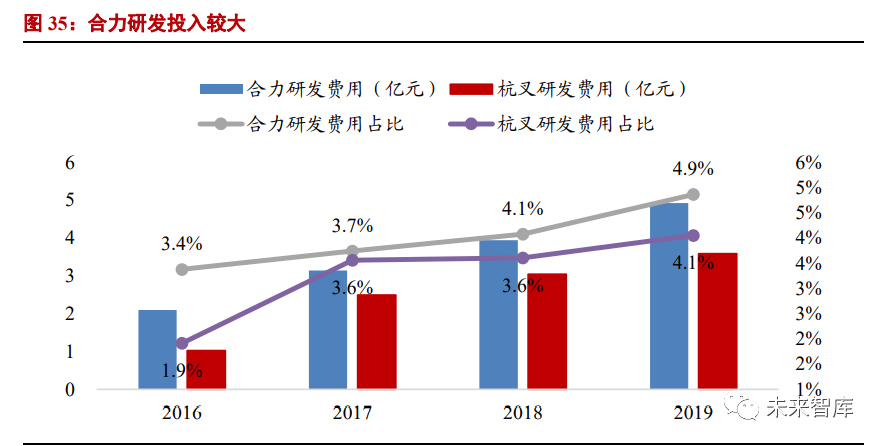

Joint efforts to invest more in research and development. From 2016 to 2019, Heli’s R&D investment was 210 million yuan, 310 million yuan, 390 million yuan, and 490 million yuan respectively, and the R&D rate was 3.4%, 3.7%, 4.1%, and 4.9%, increasing year by year. During the same period, Hangcha's R&D investment was 100 million yuan, 250 million yuan, 300 million yuan, and 360 million yuan, and the R&D rates were 1.9%, 3.6%, 3.6%, and 4.1%, respectively, and the proportion of investment was less than that of Heli.

Heli Hangcha leads the industry in the field of intelligent forklifts. Heli carried out joint collaborative innovation with China Mobile and Huawei, and launched the country's first 5G+AGV forklift application product. Hangcha, China Telecom and Zhejiang University jointly established the "5G Intelligent Control Innovation Laboratory", launched "5G-based intelligent warehousing solutions", focused on breaking through 3C, photovoltaic, power grid and other industries and made substantial progress. Hangcha AGV forklift has a very high market share in the country, and its products have successfully entered the US and Southeast Asian markets. In 2019, the revenue of Hangcha AGV forklifts is about 100 million yuan, and it is expected to achieve 150 million yuan in 2020, with a growth rate of 50-100% in 2021.

Heli Hangcha actively deploys new energy forklifts, Hangcha has a relatively high sales volume, and Heli has a fast growth rate. The key components of an electric forklift are batteries, motors, and electronic controls. In terms of batteries, Heli Hangcha has cooperated with Ningde Times and participated in Pengcheng New Energy Company. In terms of electronic control, Hangcha cooperates with Zhengzhou Jiachen Electric in Henan, and the next step will be to lay out the electric motor, in order to occupy the commanding heights of the industry in terms of three electric technology. At present, Hangcha Group's sales of new energy forklifts are the highest in the country, while Heli lithium battery forklifts are growing extremely fast, with a year-on-year increase of more than 200% in 2020 (Class III vehicles are not included here, and lithium batteries for Class III vehicles have become standard). In the field of hydrogen energy forklifts, both companies have a layout and are leading the industry. In September this year, Hangcha established Hangcha Group New Energy Forklift Manufacturing Co., Ltd. in Tianjin Free Trade Zone. The company mainly manufactures hydrogen fuel forklifts and will further expand the production capacity of hydrogen fuel forklifts.

Heli Hangcha has launched an intelligent management system to optimize forklift operations. Heli FICS intelligent fleet management system can carry out asset management and maintenance management online, monitor the status of vehicles and drivers in real time, realize the digitization and visualization of handling operations, and make forklift operations more efficient, safe and economical. Hangcha FIMS cloud intelligent forklift management system has functions such as vehicle data collection, vehicle alarm, vehicle remote control and diagnosis, vehicle scheduling, logistics tracking, etc. Level.

2.6. Hangcha's incentive method is more flexible

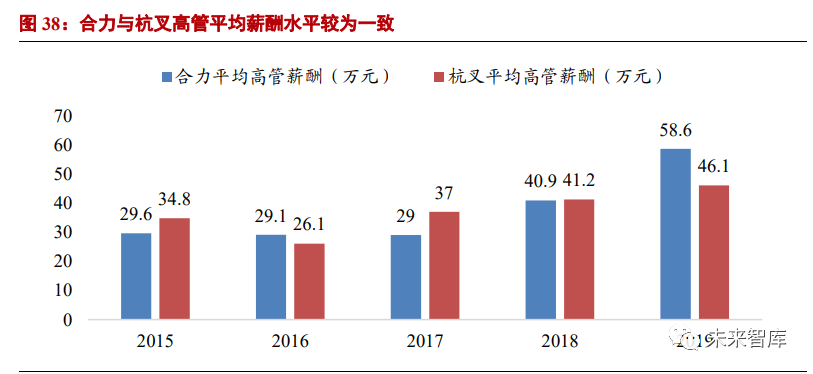

The management of Hangcha holds more shares, and Heli is more inclined to compensation incentives. The average salary level of Heli and Hangcha executives is relatively consistent, and the equity incentives are different. Heli directors hold relatively few shares, and the shareholding value is less than 10% of the total executive compensation and equity value. The management of Hangcha holds a large amount of shares, and the shareholding value accounts for more than 92% of the total income of executive compensation and equity value.

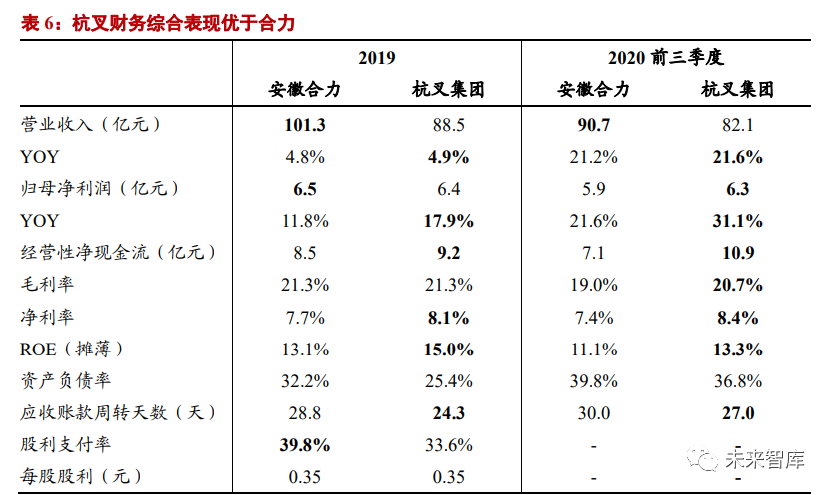

In this part, we will compare the important financial indicators of the domestic leading forklift companies to more intuitively reflect the operating conditions of Heli and Hangcha. Looking at various financial performances, Heli maintained a leading position in revenue and asset size, while Hangcha's profitability and cash flow were slightly better.

3.1. Heli’s revenue scale keeps leading; Hangcha has a high level of profitability, and its performance growth is faster than Heli

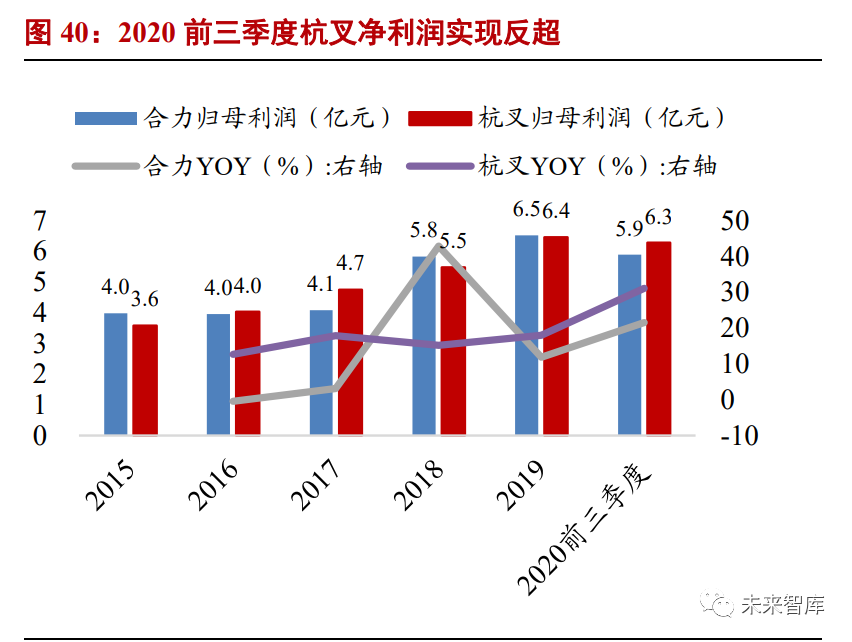

Hangcha's revenue and profits grew faster than Heli, and its net profit in the first three quarters of 2020 surpassed. From 2015 to 2019, Heli's income increased from 5.69 billion yuan to 10.13 billion yuan, with an average annual compound growth rate of 15.5%, and the net profit attributable to the parent increased from 100 million yuan to 650 million yuan, with an average annual increase of 13.1%; Hangcha's income increased from 4.57 billion yuan RMB 100 million increased to RMB 8.85 billion, with an average annual compound growth rate of 18.0%. Net profit attributable to the parent increased from RMB 360 million to RMB 640 million, with an average annual growth rate of 15.9%. Both revenue and profit grew faster than Heli. In the first three quarters of 2020, Hangcha achieved a revenue of 8.21 billion yuan and a net profit of 630 million yuan, achieving a go-ahead.

Hangcha's gross profit margin and net profit margin are higher than Heli. Although the average price of Heli products is higher than that of Hangcha, the gross profit margin and net profit margin of Heli are relatively low. The fact that Heli's employment cost is higher than that of Hangcha is a major factor, and it is also related to the different expansion strategies of the two companies. Hangcha's centralized production method can maximize capacity utilization, reduce costs and increase efficiency; Slightly less efficient. With the continuous growth of sales volume, the cost-saving advantage of Heli transportation will appear. If the quality and efficiency can be further improved, the profit gap is expected to narrow.

The ROE level of Hangcha is higher than that of Heli, and the gap between asset turnover rate and net interest rate is the main factor. In 2019, the ROE (average) of Heli and Hangcha were 13.6 and 15.8%, respectively, with a difference of 2.2 percentage points. According to the results of DuPont's serial substitution analysis, the asset turnover rate and net sales profit rate affected by 2.0 and 1.8 percentage points respectively, which were the main influencing factors; the equity multiplier was a negative effect, pulling back the gap of 1.6 percentage points. The strong profitability of Hangcha is mainly due to the high efficiency of asset operation and better cost control.

3.2. Heli has a large scale of fixed assets; Hangcha expands rapidly, and the collection situation is better than Heli

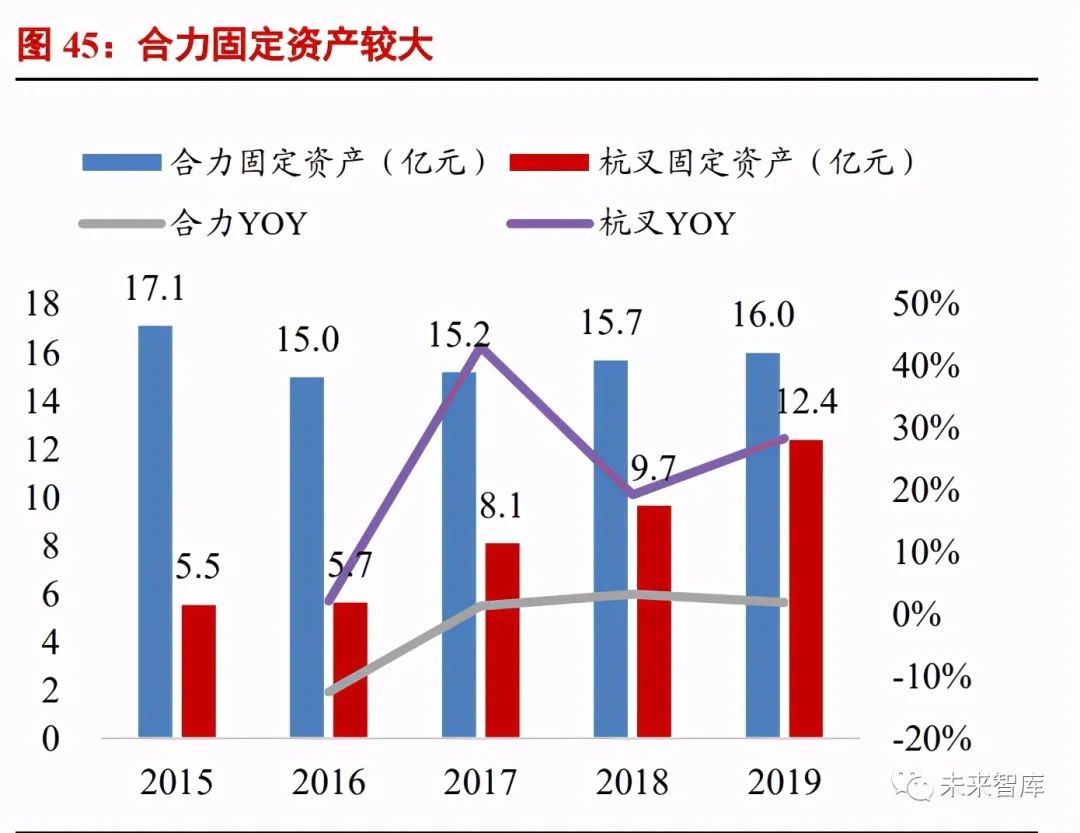

Heli has a large scale of fixed assets, and Hangcha's capital expenditure has increased in the past two years. Heli has 5 major production bases, and the scale of fixed assets is larger than that of Hangcha, which has tended to be stable in recent years. Hangcha's fixed assets have rapidly increased from 553 million yuan to 1.239 billion yuan in the past five years, and the scale has expanded rapidly. As of the end of 2019, Heli has 10 projects under construction, including projects such as capacity expansion, intelligent manufacturing, and outlet construction. Hangcha has a project under construction, "Phase II of Hengfan Science and Technology Park", which is used for intelligent manufacturing upgrade. In the past three years, Hangcha has spent more capital than Heli.

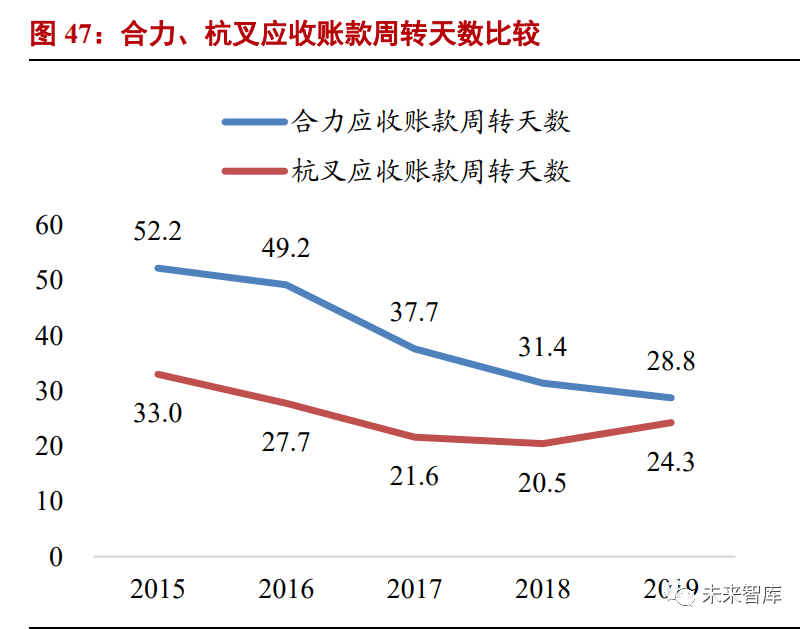

The debt ratio of Heli is higher than that of Hangcha, and the payment of Hangcha is better than that of Heli. Since 2016, the asset-liability ratio of Heli has been higher than that of Hangcha. Overall, the two companies have low debt levels and strong anti-risk capabilities. Hangcha is better than Heli in terms of payment collection. Hangcha's accounts receivable turnover days have been declining year by year, and have risen in 2019. The speed of Heli’s payment collection has accelerated year by year, and in 2019, it has approached the level of Hangcha.

3.3. The net profit cashing of both is good, and the cash ratio of the combined force is higher than that of Hangcha

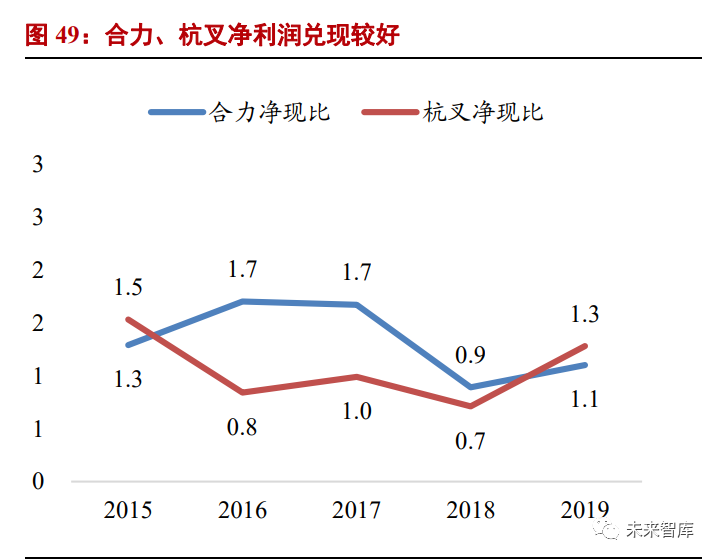

Heli found that the situation was better than Hangcha. Except in 2017, the proportion of cash received from Heli sales remained above 82%, and the proportion of cash received from Hangcha sales in the past two years was about 9 points worse than Heli. Except for a few years, the ratio of net operating cash flow to net profit of the two companies was higher than 1, and the net profit was well realized.

3.4. The performance growth of Hangcha in the first three quarters of 2020 exceeded expectations, and the market has performed better recently

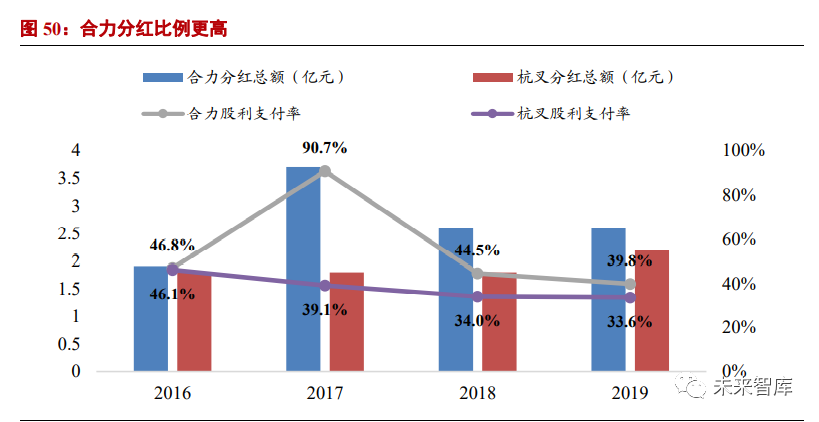

The proportion and amount of dividends of Heli are higher than those of Hangcha. Heli went public in 1996. As of the third quarter of 2020, the company has achieved a cumulative net profit of 6.81 billion yuan, distributed dividends 21 times, and accumulated cash dividends of 2.40 billion yuan, with a dividend rate of 35.2%; Hangcha was listed in 2016, and as of the third quarter of 2020, the cumulative The net profit was 2.69 billion yuan, and the dividends were distributed 4 times. The accumulated cash dividends were 770 million yuan, and the dividend rate was 28.7%. Since 2016, Heli has distributed a total of 1.07 billion yuan in dividends, and the dividend rate and amount are both higher than those of Hangcha.

The valuation level of Hangcha is higher than that of Heli. Since the listing of Hangcha in 2016, the valuation level has continued to decline. In 2018 and 2019, the PE level was comparable to that of Heli, and the PB level was higher than that of Heli. After the epidemic was brought under control in 2020, the manufacturing industry has recovered significantly, which has made Heli and Hangcha perform well in the recent market, and their valuation levels have increased. However, the growth rate of Hangcha's performance is relatively higher than expected, and the market has given them a higher valuation.

1) The growth rate of macroeconomic and manufacturing investment is lower than expected

2) The price of raw materials fluctuates greatly

3) The competition pattern of the industry has deteriorated, and fierce price wars have occurred

(The opinions of the report belong to the original author and do not represent any investment advice from us. For relevant information, please refer to the original report.)

This news comes from - Forklift Parts Platform